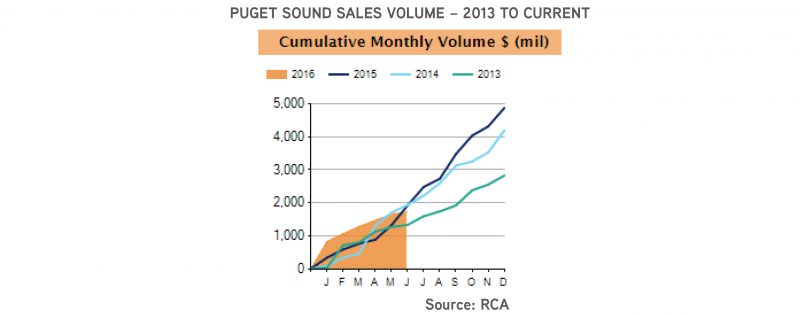

Over the course of 2015 the Puget Sound apartment market witnessed the strongest apartment sales market on record – by a long shot! The tri-County markets experienced over $4.7B in apartment sales transactions, a 42% increase y-o-y amounting to over $1.4B in additional sales volume.

[For a full breakdown and analysis of 2015 apartment sales and 15 year trends, download our 2016 Seattle Apartment Market Study.]

Sales activity in King County accounted for nearly 80% of 2015’s sales volume, clearly indicating that the action remains in and near Seattle and its core, urban markets. Based on Dupre + Scott data, year-to-date sales in Seattle totals $375M. Adjusted annually, total sales so far this year equals a paltry $900M – compared to over $2.0B in sales for 2015.

Is the market tapering or are we simply approaching a more “normal” sales environment in 2016?

What’s on the Market?

A slow-down you say? Not so fast; it’s quite early in the year. However, in order to produce sales volume the market requires new listings and those listings are scant – and in some cases a bit foreboding.

Older Stock of Apartments Elude Buyers

Merchant builders continue to lead the market as sellers de jour. Analyzing sales of apartment buildings by age, the highest percent of sales are occurring within the newly-built apartment market. Long-term holders continue to hold long-term in this market cycle.

Comparing the current market cycle to the market peak from 2004 to 2007, currently sales volume of older buildings (1995 and older) is only two-thirds the volume that sold during that time although total sales volume is up over 50%. Comparatively, sales of new buildings doubled in volume from sales occurring 2004 to 2007.

Why aren’t more owners of older buildings sellers? Primarily, these apartments have proved excellent investments. Secondarily, and arguably more poignant – lack of alternative investments.

As the current market up-cycle is the longest in recent history and pricing remains at a new peak, it is interesting that many owners of older buildings are simply not participating in an opportunity to sell at the top of the market.

Merchant Builders Ripe to Sell – with an Interesting Twist

As early as 2012, it was apparent that apartment developers were quick sellers this cycle. Developers early to the market have since recycled capital once, twice and in certain cases going-on three times. Much of the $5.5M in Seattle apartment sales volume since 2012 is the result of sales of recently completed apartment projects.

Completed merchant built projects continue to hit the market, yet in the last 6 to 8 months changes are afoot. Previously, developers considered little risk existed in the market for lease-up and stabilization. Increasingly, we are seeing developers shop buyers prior to stabilization.

Just this week, the market received the first broad marketing of a yet-to-be-complete project (a large one!), presumptively available for purchase at completion of construction. This may serve as early evidence of developer’s desire to take on less lease-up risk and market risk as we approach later innings in the development cycle.

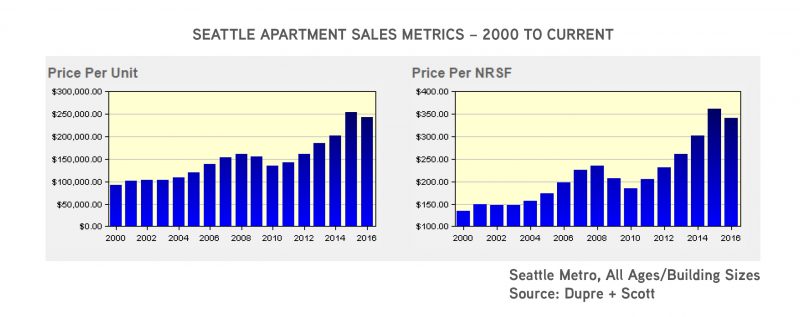

From a pricing perspective, year-to-date sales metrics do not evidence an escalation in price-points so far in 2016 – maybe these “early-seller” developers are on to something.

Land Remains a Hot Commodity – with another Interesting Twist

Seattle is one of the strongest apartment development markets in the nation. As a result, demand for development land remains robust. Each week local news sources report on developers closing on yet another apartment development site.

However, subtle differences are emerging in the market. We continue to receive calls from developers looking for great development sites. Yet, equally we receive calls from developers holding development sites (some with minimal permitting and others with permits in place) trying to understand whether to develop or sell.

Despite the strength of rental rates and low vacancy rates, development poses challenges. Construction costs continue to mount and construction lenders are requiring more equity and guarantees with mounting fears of a very large development pipeline. For the first time in the last several years, we expect to see land trading from one developer to the next.

Finally, no one can deny the influence of foreign investment in land. Although sellers of cash-flowing apartment buildings have their eye’s out for the “outlier” foreign buyer – the only “outlier” buyer this market has experienced to-date are those squarely focused on core development sites zoned for high-rise construction.

We expect the land sales market to remain dynamic, and this is certainly evidenced by opportunities to buy development land that are now hitting the market. We’ve waited some time for this change in dynamics and we expect it to remain for the foreseeable future.

From an investment sales perspective, 2016 just begun – five months of the year barely passed. Spring is a prime time for marketing new listings and those listings need time to mature into sales. As we pass through the summer the market will assuredly provide closings to measure and analyze. Yet, as September hits the window for 2016 closings certainly begins to narrow.

Is 2016 a good time for you to sell your apartment or your land and capitalize on current market conditions? You should give me a call so our team can help you make the soundest investment decision.

Would you like to know more about us? CLICK HERE TO LEARN MORE ABOUT THE TEAM

Understanding both current and future market dynamics is critically important in positioning both your assets and your capital for optimum returns. Our apartment investment sales team, comprised of five highly qualified professionals, and a back-office team of an additional four dedicated staff, specializes in assisting apartment owners in maximizing returns. We focus on representing apartment developers and buyers and sellers of apartment buildings from 5 units to 500 units. Please give me a call to discuss how we can turn our expertise into your profit. – Dylan