Extra! Extra! Read all about it… another high-rise residential development planned in Seattle! It seems as though nary a week goes by in Seattle without the announcement of another planned high-rise residential development. Note, I use the parlance “residential” as many developers are not announcing whether their next development is slated as an apartment or a condominium. For the time-being, bet on the former over the latter.

At last count, over 50 high rise residential developments (counted at 10 stories or greater) are planned for Seattle’s urban core. For a breakdown by neighborhood and year of delivery, see my recent post High-Rises on the Rise in Seattle. With a blitzkrieg of development in the high-rise space, the question remains: are high-rises a better investment than podium apartments? That question may not be answered for years to come, yet an analysis or recent rent growth offers a glimpse of what the future may hold.

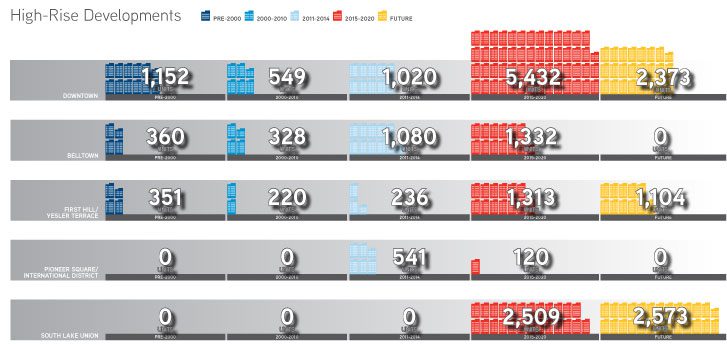

Before we take a look at rent growth, let’s take a quick look at historic inventory levels of high-rises as well as the pipeline adding to this stock.

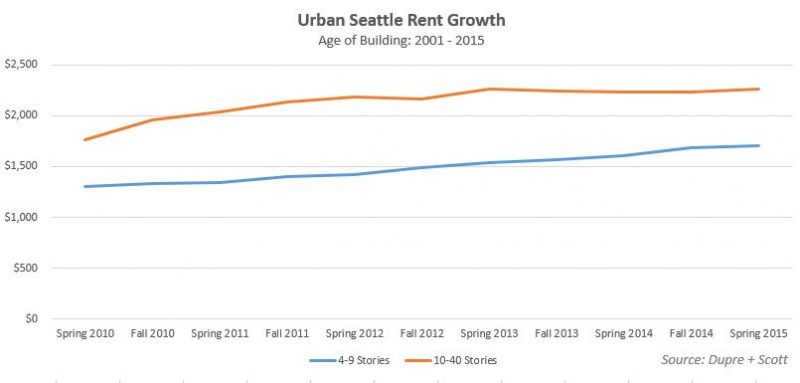

Rent Growth in Modern Apartments — 2001 -2015

As Seattle entered the 2000s, it did so with less than 2,000 units of high-rise apartment inventory. This inventory increased by 150% from 2001 to 2015 – amounting to the delivery of about 3,500 units. During this same time just over 20,000 units of podium apartments were developed. Over the last 5 years, how did each product type perform?

As you can see from this graph, no sharp trends are apparent yet greater scrutiny is required. Taking a quick look back over the last two years, one trend is clear – podium apartment rent growth far outpaced that of high-rises. Year-over-year rent growth (all facts and figures care of Dupre + Scott) for podium apartments equals roughly 5.4% – for cumulative 2 year rent growth of 10.8%. As far as high-rises, 0% rent growth in the last two years… yes, 0%.

Taking a look over the entire period studied (Spring 2000 to Spring 2015), trends offer a bit more balanced analysis. Year-over-year both asset types performed about the same, 6.0% year-over-year rent growth for podium buildings and 5.7% year-over-year rent growth for high-rises. Reviewing trends on a longer horizon helps dampen various oscillations, including the large quantum of deliveries over the last 24 months and concomitant concessions on lease-up.

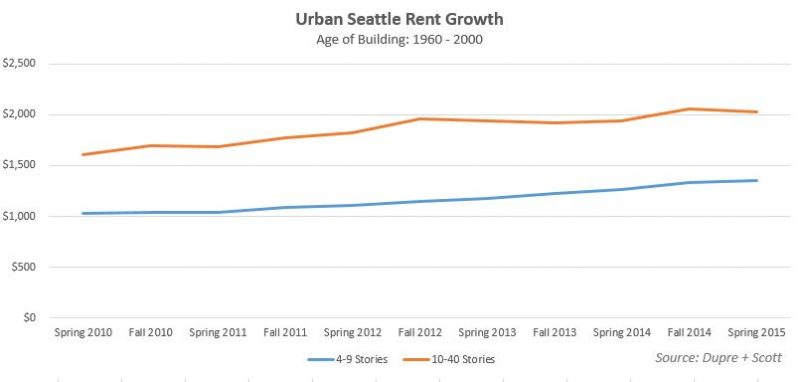

Rent Growth in Vintage Apartments — 1960 – 2000

Seattle is in the midst of an apartment development boom, if not yet, arguably soon to be the largest in its history. With such focus on new development, often times it’s the legacy assets that don’t make headlines in the morning’s paper. Yet, as any good value investor knows, headlines don’t necessarily equate to returns – but rent growth does!

Surveying quite a long range of vintage assets provides useful insight, as well as very stabilized datasets. With respect to high-rise apartments, our data is based on less than 2,000 units, yet trends remain relevant. Older high-rises experienced 2.3% year-over-year rent growth over the last two years, with rent growth likely stymied by cannibalization from modern product hitting the market. Yet, over our five-year analysis, podium rent growth equaled 5.3% year-over-year, nearly matching that of its newer, much more expensive modern brethren.

Saving the best for last, you ask? Vintage podium product experienced 7.5% year-over-year rent growth over the last two years and an average of 6.3% year-over-year rent growth over the last five years – besting all categories of product type and ages. How is that for headline worthy!

Where to Place your Investment Dollars

Our analysis is a snapshot of the market, yet a useful tool and reminder that investing requires historical analysis and viable forward looking theses. High-rise development is good for Seattle and is certainly effective at garnering headlines, as well as domestic and foreign capital. The profitability of these development endeavors necessitates much deeper analysis that what is afforded herein, yet raises interesting questions regarding competition, construction costs and other risk-factors worthy of intense measurement.

Please contact me to gain fresh and insightful perspective on Seattle’s apartment investment market and for guidance on acquisition and disposition strategies ensuring your highest level of investment return.