As we near the end of 2014, we are all avidly preparing for the holiday season and New Year – and undoubtedly planning for 2015. For the majority of my readership and client-base, that includes setting investment strategy for 2015, and possibly beyond. In this final writing of the year I would like to cover several market fundamentals that I believe are very important in developing and setting an investment thesis for the coming year(s).

Please find below a snapshot of four key concepts. This Market Update doesn’t provide adequate time to fully discuss these concepts, so please contact me to discuss them in both greater detail and in context of your investment plans for 2015.

Overview of Key Concepts:

- Seattle is getting further along in the Real Estate Cycle

- Sustained Low Interest Rates are in the Immediate Forecast (despite recent jobs reports)

- Suburban Apartment Fundamentals are Fantastic

- Apartment Development in Seattle is at an all-time High, and Growing!

What Real Estate Cycle?

The real estate business if replete with axioms and adages. One of my favorites — “real estate cycles are long, memories are short”. Given the fervent pace of rent growth and apartment development, it is a good time to revisit the concept of the real estate cycle.

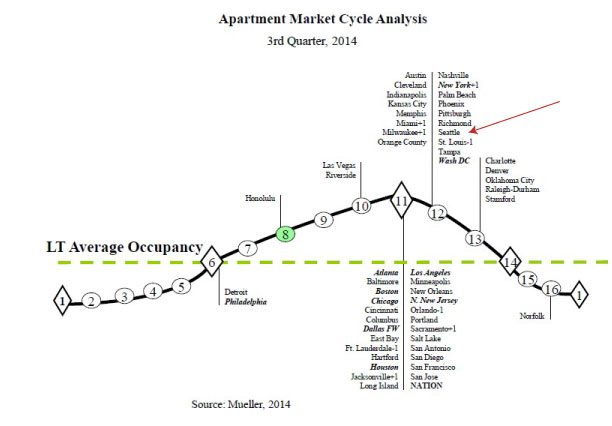

Academics and professional alike have developed various models for the real estate cycle, often quoting durational cycles in periods of years or quadrants from peak-to-trough. This forum doesn’t provide for an exhaustive list, nor discussion, of these models. However, in broad strokes, I do subscribe to and like to follow Dr. Mueller and his analysis.

The following model shows that the Seattle market is headed back towards the long-term occupancy mean, following the basics of cycle analysis – mean reversion. Although I am very bullish on the strength of the Seattle apartment investment market, as you plan for 2015 and beyond, this analysis is a helpful reminder of the greater context of real estate cycles and our position within the current cycle.

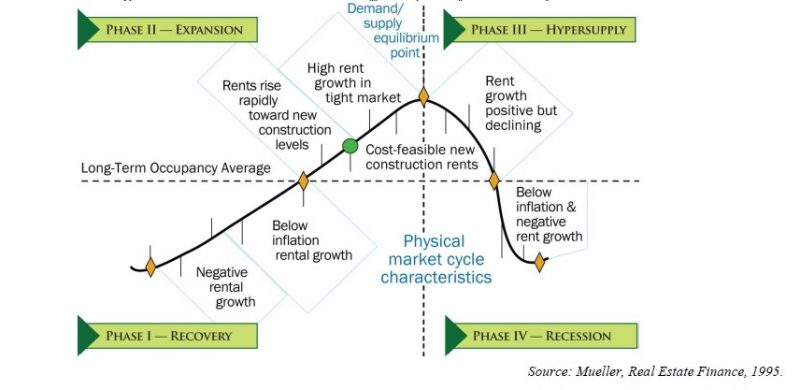

For those of you not immediately familiar with Dr. Muller’s Cycle Analysis, the following is a diagrammatic explanation.

Interest Rates Continue along Zero-Bound Path

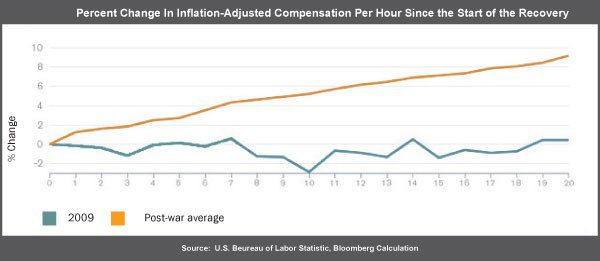

As of this writing, the 10-year Treasury Bill is at a tepid 3% – having started this year at an already historically low point of 3.0%. Although we expected rates to rise in 2014, that eventuality was dead-wrong (much to the chagrin of many a bond manager). In the last year we have closely watched employment growth to prognosticate likely rate-guidance by the FOMC to the Fed, yet it is clear that inflation and wage growth are the measures to watch.

For regular readers, you will recognize the following graph on wage inflation – or lack thereof. Given Yellen’s propensity to focus on wages versus employment I expect that interest rates will remain low in 2015, or for at least most of the year – or at least until we see a positive trend of wage inflation.

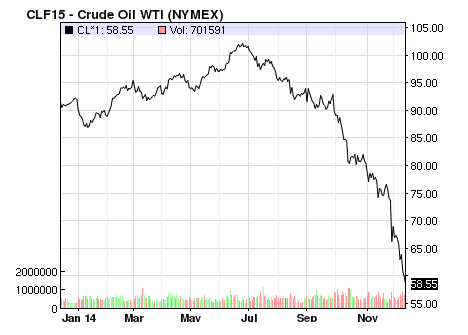

Following the aforementioned graph there are two other points to ponder that will likely impact monetary policy – declining oil prices and Europe’s impending recession.

Oil prices—they are low, extremely low. At a spot price of sub-$59/barrel, crude prices are at levels not seen since the 2008 Recession. Although common sense may lead one to believe that low oil prices spur the economy, this is seldom the case. Sustained low oil prices are a harbinger of continued stagflation – or possibly deflation – and despite employment growth, low oil prices will help force the Fed’s hand to keep interest rates low for the foreseeable future.

Source: Yahoo Finance, 12/12/2014

Finally, Europe continues its economic lag and is all but set for its third recession in the last six years. Although in Europe (like the US), there are “have” and “have not” regions (25% unemployment in Spain versus 5% unemployment in Germany), as a whole Western Europe is not doing well. As a result, the US will likely not push interest rates in order to remain competitive overseas. In a dangerous circular reference, Europe is hoping the US’s economic strength will help lift it out of its economic doldrums – a strained bet on the future.

Suburban Dynamics: Rent Growth & Low Vacancies

Currently, apartment fundamentals are good, very good. Seattle is on a tear and REIS forecasts Seattle as a Top 5 Rent Growth Market again in 2015. The real estate recover is very strong for Seattle, but it hasn’t been widespread from the beginning. If we could distill the recovery to one buzz word, it would undoubtedly be “urban”.

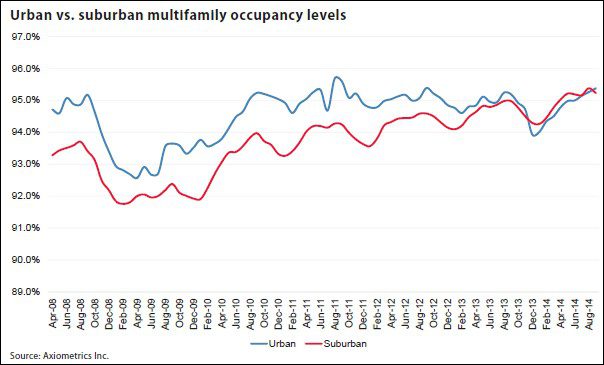

In Seattle and the country as a whole, urban revitalization and a flight to core assets (for investors and renters alike) tells the story of economic recovery for the apartment investment market. Since the recovery began in early 2010, urban markets have led all key metrics: rent growth, occupancy and development. Yet, in 2014 we saw suburban markets close the gap.

Buoyed by affordability and supply constraints, suburban markets displayed impressive rent growth in 2014. Given capital’s continued propensity for core and core-plus markets (both on the investment and development side), suburban markets are teed up for continued outperformance. Act fast, capital is on the hunt for yield and sustained low core cap rates will keep many buyers out of core markets.

In the last 12 months (on a national basis), suburban markets have closed the gap in vacancy levels as compared to urban markets. Although trends in 2014 show the markets at comparable levels, sustained new development in the core will likely lead to continued outperformance in the suburbs.

NOTE: The discussion of investor flight to secondary and tertiary markets has been a discussion point for some time. I expect even greater velocity in these markets in 2015 as the recovery broadens to all markets.

Unprecedented Apartment Development & Pipeline

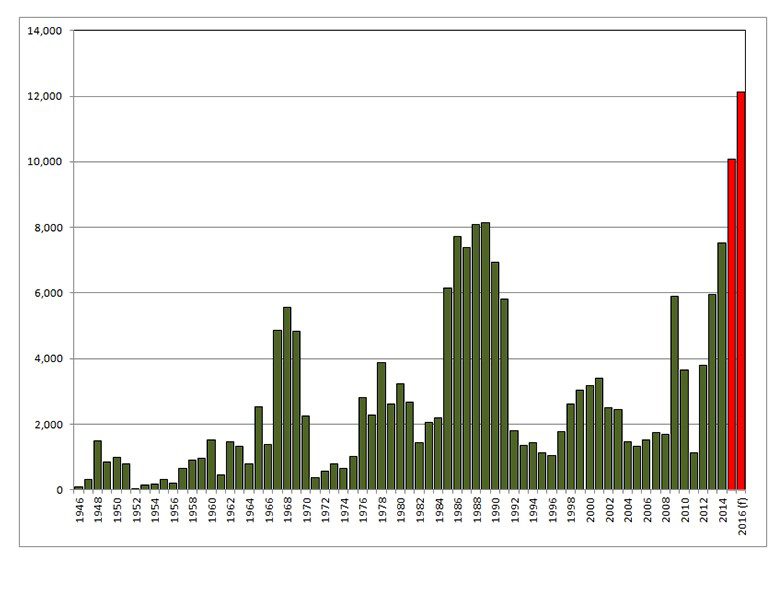

As if shouted by Paul Revere, “the apartments are coming, the apartments are coming” – Seattle’s apartment development pipeline is a storied tale, and one not even close to its final chapters. For two years I have written about the apartment development pipeline – first in my 2013 Seattle Urban Market Study and then again in my 2014 Seattle Urban Market Study.

In January 2015 I will come out with my 2015 Urban Market Study that will provide great detail on the current apartment development pipeline. There are myriad topics of discussion that can be extrapolated from all of the current development data. Not having the time or room for such a broad discussion, the following are a few data points to satiate you until next month:

- 36,000 units are planned in the next 3 years – 12,000 y-o-y

- Nearly 90% of all King County deliveries are planned in urban markets

- Snohomish County has less than 2,000 units planned from 2015 – 2017 (1,500 in Pierce County)

- 2016 marks peak deliveries at nearly 13,000 units – accounting for a 5% increase in inventory

Puget Sound Apartment Development: 1946 – 2016

Source: Gardner Economics; Dupre + Scott

Thank you to my readership and clients for making 2014 a simply fantastic year. I am signing off for the year to focus on my latest market study, due out January 19, 2015 (and close a couple final transactions for the year). Until that time, have a safe and happy holiday season and my sincere best wishes to you and your families over this joyous time of year!