If you are just joining us, I recommend you start with Part 1 of this 3 part series.

Location

The lead article I aggregated this week is emblematic of a shift in a location paradigm, and one I believe is strongly based in retail strategy. Recently, Weyerhaeuser announced moving its corporate headquarters to a controversial neighborhood – Pioneer Square. I don’t raise this to posit whether such a move is a “bad” or “good” idea, yet instead to focus a lens on attributes of Pioneer Square that support my thesis of taking guidance in retail strategy.

Taking our analysis back a few hundred years (I promise this will be quick), retailers focused on locating near points of congregation – terminals of people, if you will. Since the dawn of time, these points of congregation were ship terminals, rail terminals, trade terminals and the like.

Overlaying such an analysis onto our example of Pioneer Square reveals a few key attributes of Pioneer Square: (1) it’s a historic point of congregation; (2) it has a Main Street; and (3) it was and is a dense, vibrant transportation terminal (currently rail—light & heavy, bus—surface & subterranean, ferry, and vehicular—if you want to count proximity to three major freeways).

Retail must cluster near people – how many developers are we seeing rush to develop a suburban mall? Retail is hyper-responsive to demand and purchasers are fickle, so retailers must employ every strategy in their arsenal to capture demand (retail “capture” and “leakage” are actually terms of art on the retail world).

The following are locational overlays I feel are import in analyzing how retailers think, and accordingly how apartment investors can use such constructs to forecast demand, or in the least meet demand at the door.

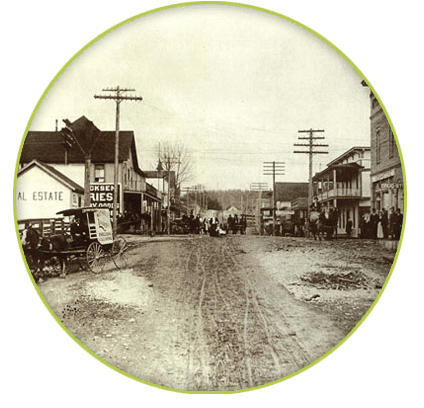

Historic Districts

In a city enamored with authenticity, historic districts are a good bet. Buildings with old bones and history have the patina sought in our retail world. The rise in popularity of historic districts across the nation chart a good path. Although one can point to districts such as LoDo in Denver and Gastown in Vancouver, B.C., we have fine examples in our own backyard.

If you look at the transformation of Ballard closely, it is clear that the rush of apartments followed great retail. Why is Ballard fantastic – old buildings, great shopping and hip, unique restaurants – all with retail underpinnings. Essentially, retail ‘found’ Ballard first.

The nascent popularity of Columbia City as a place to build apartments was precipitate by great retail. If you ask anyone why they went to Columbia City 5 years ago, it is was for great bread at Columbia City Bakery, a hearty breakfast at Geraldine’s Counter or pizza worthy of delivery to Airforce One for President Obama.

An interesting fact, the only two only areas in our region that are delineated as both Urban Villages under the Growth Management Act and are registered Historical Districts are Ballard and Columbia City.

What other areas in the region are historic in nature? Follow the retailers and get their sooner than the apartment crowd. Doing so will ensure a lower basis in land and improvements – and greatly assist in achieving market-leading returns.

Main Streets

Retailers were onto something before the mega-malls emerged in the 1950s. If you look at our neighborhoods that have fallen into vogue with the young renter-set, a Main Street is not far away.

As we have identified above, the historic attributes of both Ballard and Columbia City lend character and allure, which translates equally for retail and housing demand. Looking a bit deeper into their layout, having a retail corridor, or “Main Street”, assists in attracting shoppers and harnessing demand.

On the continuum of development, we find West Seattle attracting apartment development – on the order of magnitude of thousands of unit. Where do they flock – on or near California Avenue, another pseudo-“Main Street”.

Jumping over the pond, West Bellevue is finding its groove. In the past I have described West Bellevue’s retail capture as a metaphoric hill – once you leave the Bellevue Collection, you somewhat roll into the abyss. That was until developers found a foothold on Main Street. Over 1,500 units are either under construction or planned within 1 ½ blocks of Main Street and Bellevue Way. The retailers found it first, and apartment developers are here to follow.

Where is the next re-established Main Street? As I have suggested before, look to Bothell with Bothell Landing, a 105 year old downtown looking to capitalize on its Main Street roots. Issaquah to Edmonds and Everett to Tacoma all have main retail corridors.

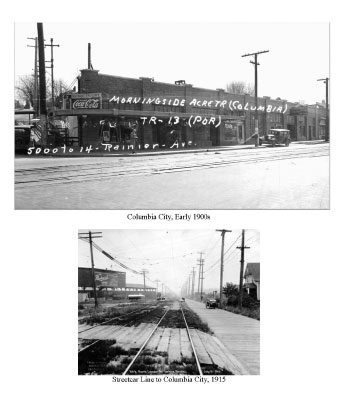

Rail Lines

Early settlers knew they had to develop efficiently. Surveyors were to the fist to plot towns that became cities and these cities depended on rail. Rail is expensive infrastructure. Accordingly, visionaries of rail transportation were cautious and thoughtful in the placement of rail lines and stations. We spent the better half of the mid-1900s removing rail lines that were laid during the previous century, only to now retrace our steps.

Looking back to Columbia City, at the turn of the 19th century, this neighborhood was served by a rail line extending to downtown Seattle. Although it has taken over 110 years, its locational attributes have now been rediscovered.

In what other centers do we find formerly laid rail? Although 10 years ago Capitol Hill and Madison Valley were not premier neighborhoods, they both are positioned on a former rail line that extended from downtown Seattle to Madison Park. The attributes that made these areas attractive for rail is now rediscovered, and I can quite confidently say these neighborhoods are thriving.

Whether you pull out maps to look for old placement of rail lines, or follow the path of our new light-rail system or the Seattle Street Car network currently underway, following rail is a safe best – and I can assure you the retailers will be waiting for you at each rail terminal.

Next week I will close out this series with Part 3 – a look at how the concept of “experience” in the retail world translates to obtaining market-leading returns for apartment investors.