It was late on a Friday night in Belltown, much too late for me. I was several rounds of drinks deep with the illuminati of cool — young, upwardly mobile late 20-somethings yammering on about all that is important to our newest generation of trendsetters. As the evening drew on, the topic turned to the following day’s apartment search.

Belltown was losing its luster, they claimed — it was fall 2008 after all. The new direction of the conversation was interesting enough to keep me at the bar, yet the mention of South Lake Union caused me to perk-up, lean forward and fire back with a litany of questions. “South Lake Union?” I asked. Really? Where, I wondered. What property? And most saliently … why?

My research often traverses the empirical to the anecdotal, and it is this latter vein that interested me most about South Lake Union. How did a neighborhood emerge out of almost nothingness and achieve status so quickly?

Having spent my post-college years in San Francisco, I am well versed in the common migratory patterns of urban 20- and 30-somethings. They graduate from one neighborhood to the next, with each change incrementally ratcheting up the evolutionary chain of maturity evidenced by the chosen neighborhood.

In San Francisco, we moved from the Marina to Pacific Heights, or from the Mission to Nob Hill. For years young Seattleites served time in their early 20s in Belltown, eventually tiring of the “scene” and advancing to Upper Queen Anne or Greenlake.

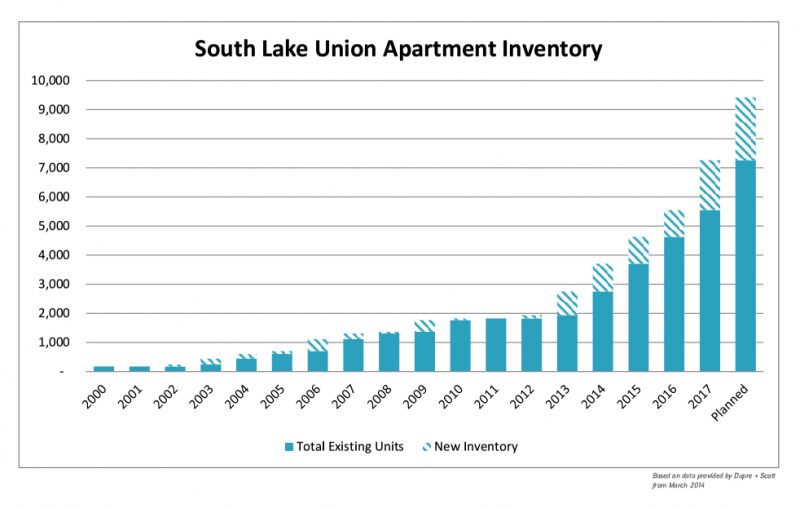

With the advent of South Lake Union as a residential neighborhood, a new option emerged. I use the term “advent” as South Lake Union was hardly considered a residential neighborhood as recently as the turn of the century. In 2000, less than 180 market-rate rental units existed in South Lake Union. However, a transformation was on the horizon.

The Neighborhood Forms

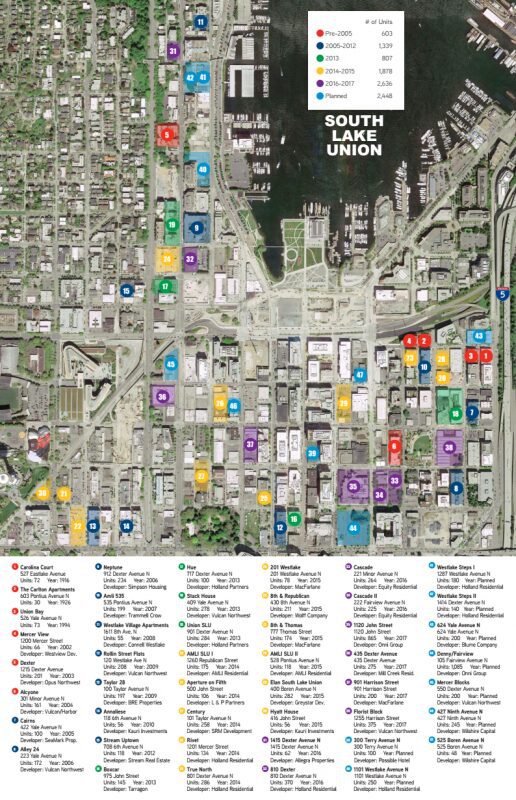

South Lake Union’s residential development beginnings were humble, and in the context of time, not that long ago. The defeat of the Seattle Commons project served as a principal catalyst to development, leading Paul Allen to increase his land holdings in South Lake Union from 11.5 acres in 1992 to 45 acres in 2001. In three additional years, Vulcan increased its South Lake Union land holdings to 60 acres.

Although Vulcan was a predominant force in the early residential development of South Lake Union, it wasn’t the first and certainly wasn’t the only major developer. Westview Development presciently developed Mercer

View as early as 2002 and the then-powerful Opus Northwest completed Dexter Apartments, a 201-unit apartment complex, in 2003.

The key window of residential development is clearly the last decade. With a scant stock of modern apartment buildings existing in South Lake Union as recently as 2003, the market grew to nearly 3,300 units from 2004 to 2014. For the sake of comparison, South Lake Union has now outpaced Ballard, which had more than 1,000 apartment units as early as 1996.

The development cycle continues to gain steam. Looking beyond 2014, more than 5,710 residential units are planned for South Lake Union. If built, the total unit count in South Lake Union will be roughly equal to all existing and planned units in both Ballard and West Seattle combined.

Land & Building Prices

Increased focus and attention on South Lake Union directly equates to substantial land price escalations. In the early 1990s, South Lake Union was dominated by industrial laundries, shipyards and warehouses, and accordingly, the basis for Vulcan’s original land purchases were in the $40 per square foot range. As soon as the early 2000s, land prices broke into the $100 to $150 per square foot range, with some smaller sites selling in excess of $350 per square foot.

By 2007/2008, land sales routinely rose to the $250 to $350 per square foot range. Yet, during the ensuing downturn, beginning in 2009 and lasting as late as 2012, land prices declined as much as 50 percent.

Currently, buyers can expect to see pricing in the $350 to $500 per square foot range, with a heavy dependency on zoning, which changed markedly with the City Council’s approval of the South Lake Union rezone in May 2013.

Land pricing on a per-unit basis has become a less reliable metric. The market has witnessed relatively recent sales of entitled sites in the $60,000 to $80,000 per unit range, all the way up to high-watermark pricing paid by McFarlane Partners for an unentitled site at more than $70,000 per unit.

The history of sales of existing apartment buildings in South Lake Union is surprisingly uninteresting. Despite the investment community’s voracious appetite in 2012/2013 for urban apartments, both pre-sale and existing buildings, South Lake Union has experienced very few sales. You can count them on two fingers: Cairns in 2007 and Annalise in 2013, both purchased by Essex Property Trust.

Rental Rates the Envy of the Region

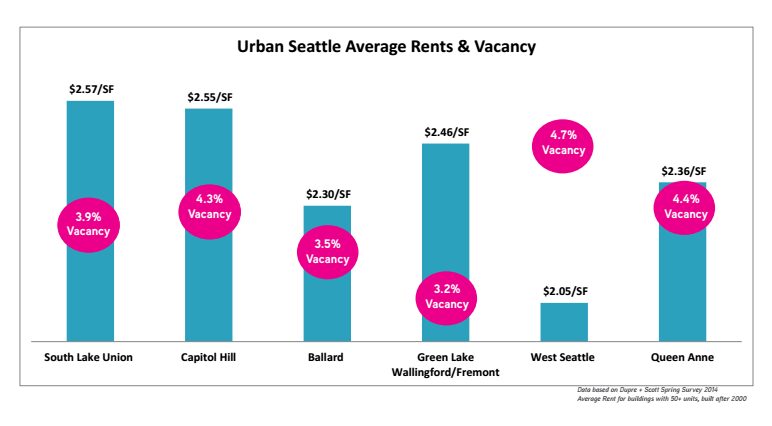

Rental rates in South Lake Union lead the Seattle market. A survey of modern apartment complexes substantiates rental rates in the $2.65 to $2.90 per square foot range, rates that compete directly with Capitol Hill and downtown apartment buildings.

When looking at South Lake Union’s average rental and vacancy rates, there is some complexity in the analysis. Dupre + Scott, the region’s most respected and accurate apartment data provider, does not provide a perfect data overlay for South Lake Union. Nonetheless, results from recent surveys we have taken validate that average rental rates and vacancy reported by Dupre + Scott are truly indicative of the South Lake Union market.

As of March 2013, according to Dupre + Scott, the average rental unit in South Lake Union will cost you $1,943 a month. When focused on 2010 and newer buildings, average rents climb to $2,101/unit and a two-bedroom unit will cost you an average of $2,694. Pretty impressive numbers for an area of town where industrial users were paying less than 60 cents a square foot just a decade ago.

Vacancy rates have also trended to a near 10-year low of 4 percent. As recent as spring 2009, vacancy rates in South Lake Union peaked at 8 percent — mostly due to a glut of supply coming online at that time. In the last nine quarters, vacancy rates in South Lake Union have remained below 6 percent. Continued apartment supply coming online will certainly impact vacancy rates in the coming years, yet absorption figures have remained tremendously strong.

A Neighborhood to Call Home

The greatness of Seattle neighborhoods exists in their history and nuance. Boutique coffee shops, overgrown foliage, farm-to-table restaurants and authentic retail. A quick stroll through Ballard, Fremont or Pioneer Square gives a sense of how Seattleites value neighborhood character. Essential to South Lake Union’s preeminence as a desirable and livable neighborhood is the development of character and authenticity. The story of definable neighborhood characteristics in South Lake Union is yet to unfold, yet opportunities for distinction abound.

South Lake Union has made great progress in its metamorphosis from an industrial center at the edge of downtown Seattle to a residential destination of choice. As far as remaining industrial uses go, few remain. The sole car dealership is the tony Tesla showroom, a far cry from the former Ford Model T assembly plant repurposed to Public Storage. Development of the Troy Blocks — a former industrial laundry — began this year. Keep an eye out for further transformation and residential appeal; I have a strong sense that the excitement is just beginning.