AUTHOR’S NOTE: This post was originally penned a few days ago – which even then seemed like a whole different world from today – yet, I nonetheless retain conviction of the content, even more so given’s Seattle deep connection to and market-leading position with global health, biosciences, and predictive health research.

When thinking about market cycles, one must invariably focus on the timing of investing. Common sense dictates that you want to invest when an investment market is “good” and refrain from investing when a market is “bad.” You can rightfully imagine a friend suggesting, “The market is good; you should get into it!” Yet, should that friend recommend, “Come invest; the market is really taking a turn for the worse,” you might question the guidance of that friendship.

Who wants “bad” anything, much less a “bad” investment or investing in a “bad” market?

More practically, investment timing is rather fluid—a continuum in a sense. One invests in rising-tide markets, but when the tide ebbs, you naturally pull back.

Yet how do we really know the future direction of the tide?

Over the years, I’ve discussed the pontification and prognostication of the commercial real estate industry, and the fact that forecasts are vastly more plentiful than accurate. There is no question the Seattle commercial real estate market deserves the label of a “good” market, but as cycles go, the cycle must turn.

When? We don’t know.

Why? We don’t have a handle on that either. (Editorial: we have greater insight today than just 10 days ago!)

For how long? That is the question I’m here to address.

In this final segment of our three-part series, we focus on market cycles. I will demonstrate that the contraction in the cycle, which logically follows our historically long expansion, will be both shallow and short.

The Trilogy of Seattle’s Resilience:

Part 1: Seattle’s Resilience – Demand (1/24/2020)

Part 2: Seattle’s Resilience – Unique Tech (2/14/2020)

Part 3: Seattle’s Resilience – Market Cycles

To best understand what the future of the current market cycle holds, READ ON.

The Cycle is Long in the Tooth

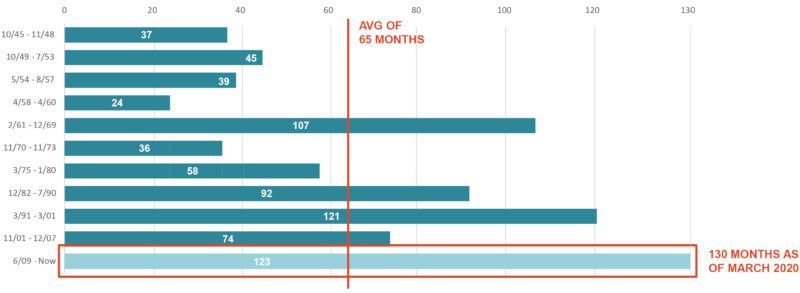

It is beyond dispute that the global economy is due for some form of slowdown, if not a recession. We just entered the 130th month of an expansion cycle, and an average expansion cycle in the United States lasts 65 months—only half of the current expansion.

Post WWII Economic Expansions – Total Months in Recovery

Given that contractions follow expansions, how should we best prepare for a contraction in the economy, specifically in commercial real estate?

First step: understanding recessionary periods.

Understanding Triggers of Recessionary Periods

Recessions are triggered for many reasons. According to popular perception, whatever slowdown is coming our way will likely be mild compared to the Great Recession. When it comes to the depth of a recessionary period, two major risk factors are: (1) housing, and (2) credit.

The Great Recession of 2008 comprised both; it is therefore not shocking that it was deep and prolonged.

Although we may not know the timing of what I will call, for now, “The Not-So-Great Slowdown,” investors are already bracing for a recessionary period.

We don’t know what will trigger it, when it will come, or how long it will last, yet we are all talking about it and fearing it.

For Seattle, it will look much different than it did in the last market cycle, and because of that, we must prepare much differently.

Seattle’s New Economic Cycle

Coming into the Great Recession, Seattle and the Puget Sound region were late to the party. While major West and East Coast markets experienced slowing as early as 2006-2007, it wasn’t until mid-2009 that Seattle joined the festivities.

Nearly five years ago, I wrote about Seattle’s NEW Real Estate Cycle. In that post, I discussed how Seattle used to be a “last-in/last-out” participant in recessionary periods, yet in this last market cycle we were a “last-in/first-out” market. I also argued that we’ve joined the ranks of other “first-in/first-out” markets.

You can review that post, but in short, I made the argument that the region’s ascension as a global city and technology center now drives its economics far more than its timber and aerospace past.

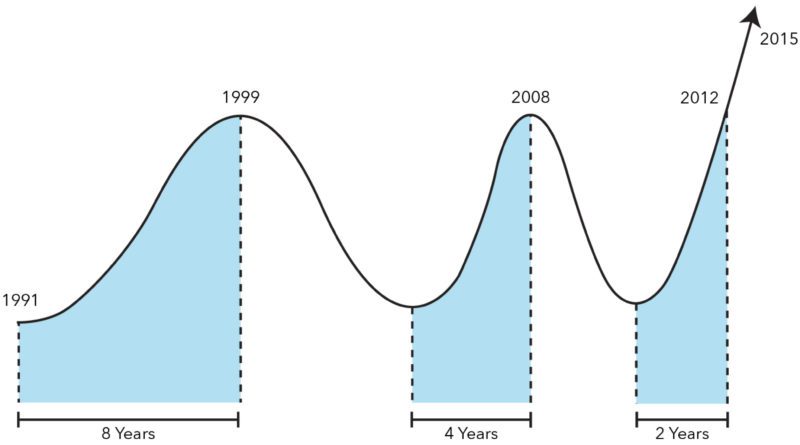

As part of that analysis, I also made the argument that other such global, technology-driven cities, (namely San Francisco) have begun to experience longer expansionary periods and shorter periods of economic contraction.

San Francisco’s Economic Cycle – 25 Years of History

Due to the globalization of technology in the current Information Age, San Francisco continues to weather recessionary periods with much greater economic virility. As the technology produced in San Francisco improves, so does its impact on local economics, even in times of economic contraction.

The net result is that their contractionary periods are shortening.

The same will happen in Seattle, as we saw as early as 2012 when Seattle came into the Great Recession late yet left the recessionary period early (alongside cohort markets like San Francisco and New York).

In the first two installments of this series, we studied Seattle’s Resilience – Demand and Seattle’s Resilience – Unique Tech. These factors will come into play regarding the duration of whatever contraction period global economies (including Seattle) experience in the next 24 months.

Preparing for your Investing Future

The most prescient (and profitable) commercial real estate investors in the Seattle region were doubling down on the Emerald City in 2009-2010, when the rest of us were recoiling, facing the near certainty of financial Armageddon.

Who was right?

It’s clear now that those investors and developers who bought back into the market before anyone else were more clairvoyant than crazy.

Some may think it takes guts to go against the grain, but it only takes being a student of the market and having a 10 and 20-year vision to make great investment decisions.

It may seem early, but now is the time to start making those bets. To understand where and how, give us a call. We are excited to partner with you in 2020 to help you achieve your investment goals – during this economic cycle, and the following one. Allow Us to Turn Our Expertise into Your Profit!

POST SCRIPT: We at the Multifamily Investment Team — MIT remain highly sensitive the deep local, national, and global impacts of the Corona virus (COVID-19) that clearly reached pandemic proportions this past week. We all need to act as both local and global citizens as we work through a challenging period. We feel privileged to be part of Seattle’s community of the brightest minds in technology, sciences, and innovation – and know these attributes will once again ensure the Seattle/Puget Sound region sits atop the world as a terrific city to live, work, and invest.

Want to keep up with our listings of buildings/land for sale, research, and industry updates throughout 2020? Subscribe to our investor newsletter and follow our team page on LinkedIn!